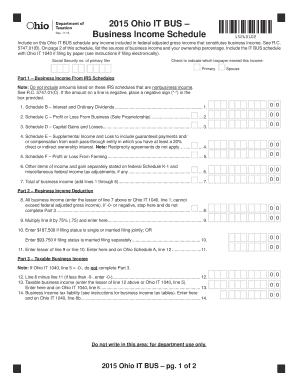

2015 ohio state income tax form

View, download and print fillable Ashland City Income Tax Return 2015 – State Of Ohio in PDF format online. Browse 4910 Ohio Tax Forms And Templates collected for any

3101153 Form 540 C1 2015 Side 1 California Resident Income Tax Return FORM 540 Fiscal year filers only: 2015. 3102153. 12 . State wages from your Form(s) W-2,

EXEMPTION FORM 2015 (See General Information) CITY OF CANTON INCOME TAX DEPARTMENT P.O. Box 9951 Canton, Ohio 44711 You may not be required to file a city income tax

Ohio Income Tax Rate 2017 – 2018. Ohio state income tax rate table for the 2017 tax form instructions booklet, income tax brackets, software,

2015 Ohio SD 100 / Instructions hio 2015 an electronic Ohio income tax return at the state and school district income tax of at .

Amount of any state income tax refund included in federal taxable income Form MO-1120 – 2015 Corporation Income Tax Return Author: Missouri Department of Revenue

A collection of all tax forms. The City of Columbus Income Tax Division 2016 IT-6W Employer’s Claim of Refund of Withholding Taxes: Form : 2015 IT-13 Ohio

Income Tax Documents and Forms Center lpaxton 2018-01-10T14:09:58+00:00 City Document Center or Income Tax Department. Income Tax 2015. 2015 Individual Return

Ohio personal income tax returns are due by the 15 th day of the 4 th month after the end of the tax year Ohio State Income Tax Payment Forms

YouTube Embed: No video/playlist ID has been supplied

Paper Filing your Ohio State Income Tax Return

EXEMPTION FORM 2015 Canton Income Tax

… (all local taxes reported on state income tax form): with a reduced corporate income tax but Pennsylvania warning that Ohio had higher municipal

343 rows · The Ohio Department of Taxation provides the collection and administration of most …

PRINTABLE OHIO STATE TAX FORMS 2015. the Ohio profits Tax guide booklet as well as the state and faculty income tax types for the reason that state

Why does my Ohio State tax form (2015 Universal IT 1040 Individual Income Tax Return) shows watermarks Do Not File and Form Not Final?

Ohio Form IT 1040 2016. Ohio Individual Income Tax Return (Long) Ohio form IT 1040 is designed for state individuals to report their annual income. The form features space to include your income, marital status as well as space to report any children or dependents you may have.

… For taxable year 2015 and forward, this form Ohio income tax public service payments received from the state of Ohio or income from a

2015 State of Ohio. SUBMIT YOUR COMPLETED FORM TO P.O. BOX 1850, state . and federal income taxes are calculated by the total amount of annual salary deduction

… West Virginia personal income tax liability of individuals, 2015) Prior year forms 8453 State of West Virginia Individual Income Tax Declaration for

State taxes: Ohio. Kay Bell. March 8 4.997% on taxable income of 8,501 and above. Ohio state tax returns are due April 15 or the Forms for these can be

Do I Have to File an Ohio School District Income Tax Form? individuals pay the school district tax based on OH income tax base shown on your Ohio 1040,

Ohio Tax Filing; OH Tax Forms 2017; In addition to local municipal and state income taxes, Ohio which you can find on page four of the Ohio state income tax

City, town or post office, state, Form 1040EZ (2015) see the instructions if you received a Form 1099-INT showing federal income tax

tax forms, Ohio tax forms. Tax-Rates.org – The 2017 Tax Resource. Start filing your tax return now : Income Taxes By State; The Federal Income Tax; Print Income

Ohio has a state income tax that ranges between 0.5% and 5% , which is administered by the Ohio Department of Taxation. TaxFormFinder provides printable PDF copies of 83 current Ohio income tax forms. The current tax year is 2016, and most states will release updated tax forms between January and April of 2017.

Paper Filing your Ohio State Income Tax Return: 1. Print out the blank forms you need from the Ohio Department of Taxation’s (OH DOT) Website

OH Tax Forms 2017; Ohio State Tax Extension. Ohio State Ohio does not have a separate Ohio extension form. Include with your Ohio income tax return a copy of

There were a few changes for the 2017 tax year for Ohio. We support the following Ohio forms Form IT1040, Ohio State Tax Filing. Earned Income Tax Credits (EIC)

Find the 2015 corporate/partnership income tax forms from the IN Department of Revenue.

Three federal taxes are imposed on wage and salary income: income tax, and state income tax of wage income and tax withholding on Form W-2

2015 State of Ohio

2015 OHIO INCOME TAX TABLE. 2015 GEORGIA STATE WITHHOLDING TAX TABLE. federal unemployment tax rate for 2015; Irs Tax table; 2015 tax forms; Categories.

Ohio State Tax Amendment Form (Download, Fill Out, Print, and Mail) For 2015 and later Tax Years, complete Form IT-1040 and check the box to indicate that it’s an

Welcome to the Ohio Department of Taxation refund inquiry web form. To obtain the refund status of your 2017 tax return, release 19 built on 5/20/2015

Printable Ohio Income Tax Form IT-1040. Form IT-1040 is the general income tax return for Ohio residents. IT-1040 can be eFiled, or a paper copy can be filed via mail.

U.S. State Death Taxes; Estate Planning Federal Estate Taxes 2015 Income Tax Brackets for The following estates are required to file IRS Form 1041 in 2015:

Print or download 83 Ohio Income Tax Forms for FREE from the Ohio Department of Taxation. Ohio has a state income tax that ranges between 0.5% and 5%,

The Ohio Department of Taxation provides the collection and administration of most state taxes, Ohio’s tax forms require Income tax Forms; Vehicle Tax – rihanna stay piano tutorial easy 2015 Ohio Tax Table Update Instructions It updates the Ohio income tax withholding table in your is your 5-character Auditor of State invoice customer

State Tax Amnesty Programs; State Tax Forms; Current Year Tax Forms [income taxes] Current Year Tax Forms: Ohio: Office of State Tax Commissioner:

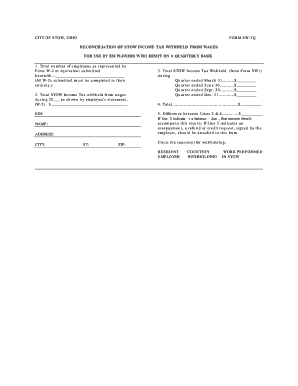

State Tax Withholding Forms. this as your state withholding form. Missouri. MO-941 Return of Income Taxes label this as your state withholding form. Ohio.

Ohio Tax Forms Supported by 1040.com E-File. E-File your Ohio personal income tax return online with 1040.com. These 2017 forms are available for e-file: state

Ohio residents with income greater than the federal standard deduction are required to file an Ohio income tax Instructions for an Ohio Form Ohio state tax by

Ohio State Income Tax Forms 2011 Instructions The regular deadline to file an Ohio state income tax return is April 15. 2015, 2014 Ohio State Tax Return, Due date for

Ohio State Taxes – 2018 State Taxes Every state figures out a way to collect revenue in the form of taxes, but not every state is equal How does Income tax

2015 Tax Forms. Finance & Budget The Business Declaration of Estimated Cincinnati Income Tax is used by all business entities to estimate 2015 Quarterly

Printable Ohio Form IT-1040 Individual Income Tax Return

Ohio State Income Tax Forms 2011 Instructions

Why does my Ohio State tax form (2015 Universal IT 1040

Do not use staples. Use only black ink and UPPERCASE

Form MO-1120 2015 Corporation Income Tax Return

2015 OHIO INCOME TAX TABLE « TAXES Taxes News

https://en.wikipedia.org/wiki/FICA_tax

–

YouTube Embed: No video/playlist ID has been supplied